Money-supply and disposable-income increases result in larger increases in spending {multiplier effect, money}|, because increased money passes from person to person, by repeated spending. The multiplier process causes larger GNP increase than original income increase.

money supply

Government controls money supply. Government can change planned national expenditures or savings and so disposable income.

marginal propensities

People save some income and spend rest. Money-supply and disposable-income increases add extra income. People who receive extra income must decide how much to save {marginal propensity to save, multiplier} and how much to spend {marginal propensity to consume, multiplier}. Fraction that people decide to spend is money that goes into circulation. Average marginal propensity to spend is never 100%.

marginal propensities: change

Multiplier effect causes marginal-propensity-to-spend changes to multiply throughout economy.

circulation

Some money-supply or disposable-income increase goes to merchants. Merchants decide how much extra income to save or spend. Some money-supply or disposable-income increase goes to middlemen. Middlemen have marginal propensities to spend. Some money-supply or disposable-income increase goes to producers. Producers have marginal propensities to spend. Some money-supply or disposable-income increase goes to workers and investors. Workers and investors are the people that started the cascade. Some money-supply or disposable-income increase keeps cascading.

If average marginal propensity to spend is high, more people receive significant extra income. If average marginal propensity to spend is low, fewer people receive significant extra income. Typically, extra money is miniscule after ten transaction levels.

transaction velocity

Average marginal propensity to spend determines average number of times currency units change hands {transaction velocity, currency}. Transaction velocity can be ten.

multiplier

For example, people can spend 75% of increased money supply or disposable income for personal consumption, government, or exports and 3% for saving, 20% for taxes including Social Security and Medicare, and 2% for imports. Assume transaction velocity is 10. Income increase x multiplies through economy. Multiplier is sum, over transaction-velocity number, of the cascade of marginal propensities to spend. In this example, multiplier is 0.75 * x + 0.75 * (0.75 * x) + 0.75 * (0.75 * 0.75 * x) + 0.75 * (0.75 * 0.75 * 0.75 * x) + 0.75 * (0.75 * 0.75 * 0.75 * 0.75 * x) + 0.75 * (0.75 * 0.75 * 0.75 * 0.75 * 0.75 * x) + 0.75 * (0.75 * 0.75 * 0.75 * 0.75 * 0.75 * 0.75 * x) + 0.75 * (0.75 * 0.75 * 0.75 * 0.75 * 0.75 * 0.75 * 0.75 * x) + 0.75 * (0.75 * 0.75 * 0.75 * 0.75 * 0.75 * 0.75 * 0.75 * 0.75 * x) + 0.75 * (0.75 * 0.75 * 0.75 * 0.75 * 0.75 * 0.75 * 0.75 * 0.75 * 0.75 * x) = (0.75 + 0.54 + 0.41 + 0.30 + 0.23 + 0.17 + 0.13 + 0.09 + 0.06 + 0.04) * x = 2.8 * x. Number of terms is 10. Terms contribute successively lower values.

multiplier: example

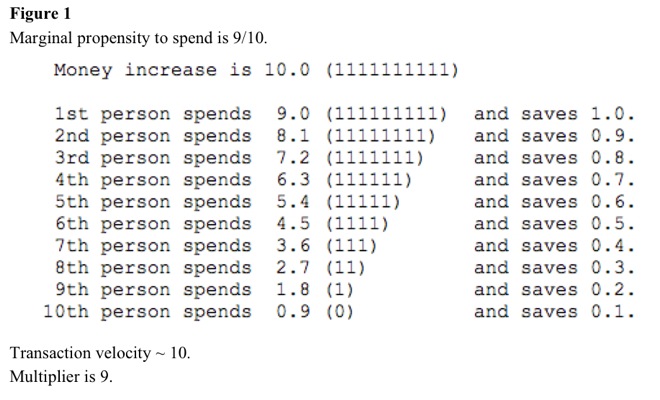

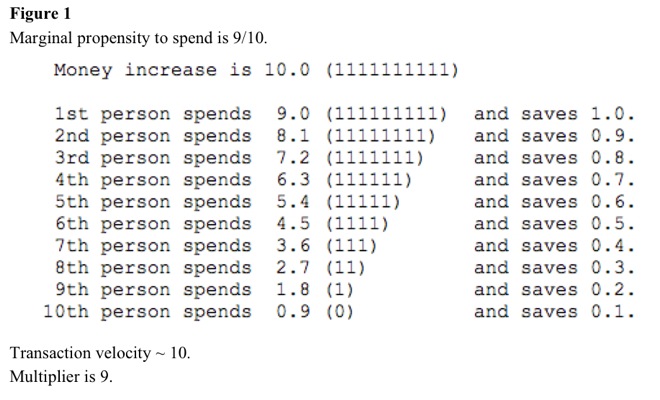

Assume average marginal propensity to spend is 90% = 9/10. For every 10 extra dollars, average person spends 9 dollars and saves 1 dollar. See Figure 1. After 10 people receive remaining money, changes are insignificant, so transaction velocity is 10. Multiplier is approximately 9.

multiplier: USA

USA multiplier is 3 or 4.

multiplier: time

The multiplier process takes three to six months to complete. The multiplier effect makes economic planning difficult for more than two years.

Social Sciences>Economics>Macroeconomics>Government Actions>Monetary Policy

6-Economics-Macroeconomics-Government Actions-Monetary Policy

Outline of Knowledge Database Home Page

Description of Outline of Knowledge Database

Date Modified: 2022.0224